31+ Earning Yield Gap Background. A low ratio may indicate an overvalued stock, or a. One should normally use the yield gap when evaluating bonds and.

Yield gap analysis, which measures the difference between potential and actual yield, is a useful starting point for identifying intensification prospects.

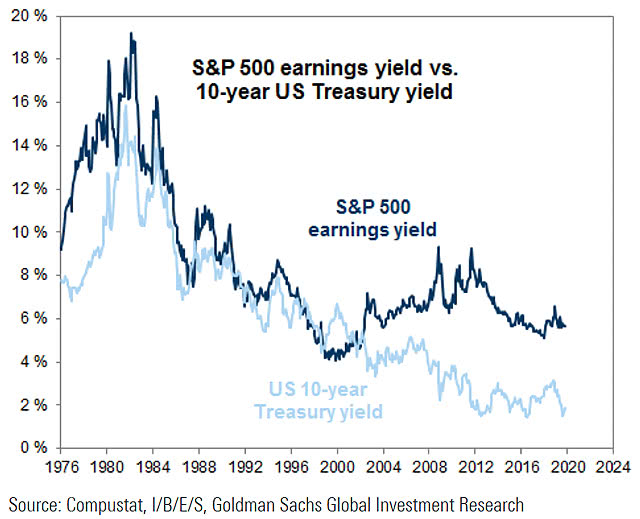

Typically equities have a higher yield (as a percentage of the market price of the equity) thus reflecting the higher risk of holding an equity. The yield gap analysis is carried out to identify the gaps where crop yields are not increasing at a pace enough to meet the demand for food. Yield gap analysis, which measures the difference between potential and actual yield, is a useful starting point for identifying intensification prospects. In depth view into gap earnings yield including historical data from 1976, charts, stats and industry comps.

Tidak ada komentar:

Posting Komentar